Quick Links

ToggleSmart business budgeting can be the one significant change you can make to help your small business become more efficient and profitable this new year. With its benefits, you can make more informed decisions to reach your business goals and expectations. These five business budgeting tips in this article will help you establish and manage an effective business budget planning project.

What are the Benefits of Business Budgeting

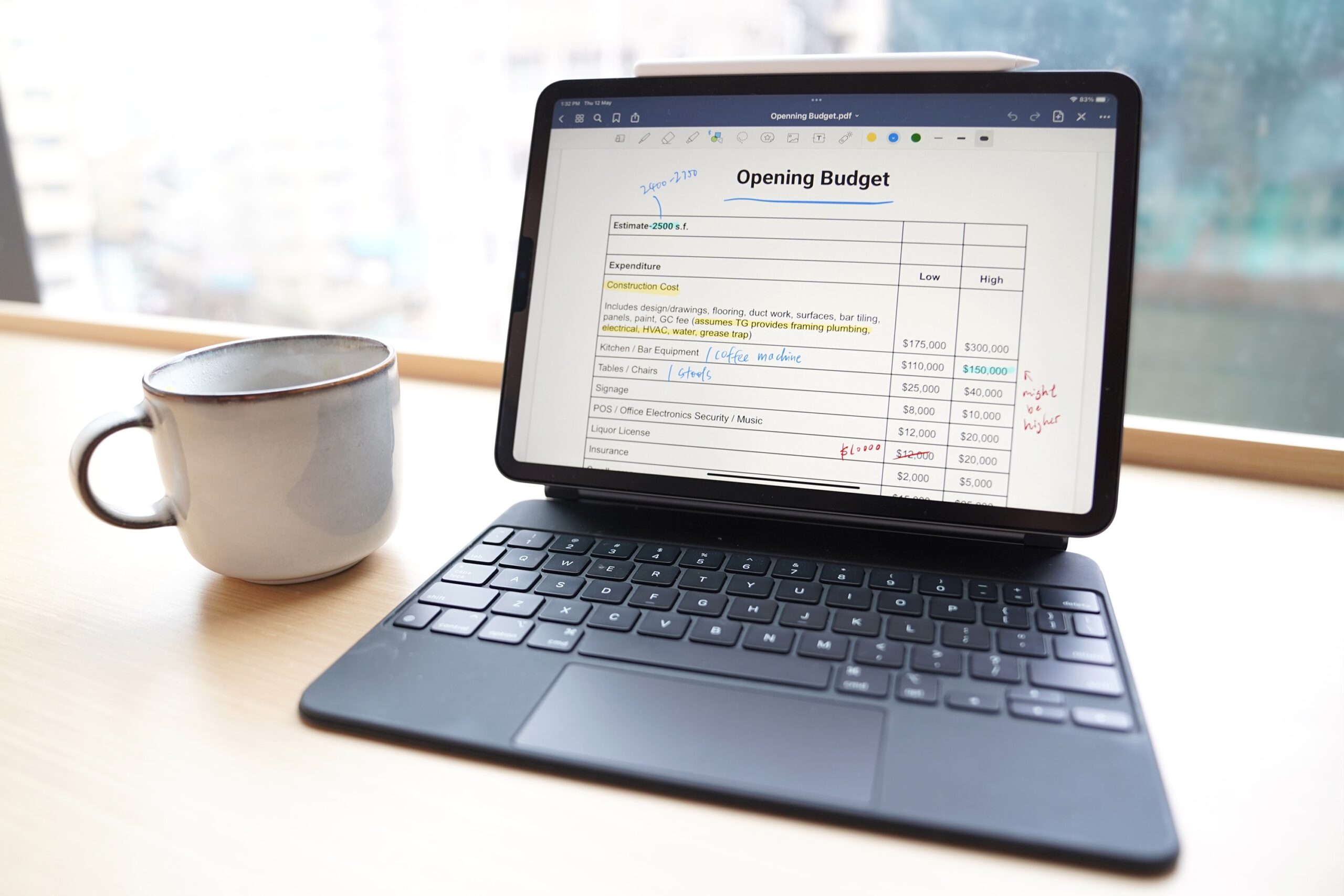

Business budgeting is the process of creating and maintaining a financial document detailing estimates of your business’s revenue and expenses on a weekly, monthly, quarterly, or yearly basis. With sound business budgeting, you can better perform cash flow management, forecasting, goal setting, priority planning, and performance evaluations. It also helps you do the following:

- Ensure the availability of resources

- Prevent overspending

- Make better business decisions

- Promote teamwork and overall communication

Getting Started with Your Business Budgeting Plan

You may already have a casual budget plan. But now is the time to assemble a solid financial strategy for the year with these business budget planning tips.

Tally Your Business Expenses

You can make this task easier by separating costs into fixed, variable, and unplanned. Fixed costs are ongoing, unchanging expenses, such as lease payments, internet services, insurance, and loan payments. On the other hand, variable costs usually change with volume, such as the cost of goods and services, fuel for business vehicles, commission, and overtime.

Since unplanned expenses are challenging to estimate, you can use past emergency costs as a guide. If your business is new, you can research to find what unexpected expenses commonly happen in your type of business. Both methods will allow you to estimate how much of your revenue you should put aside for these expenses.

Do a Revenue Estimate

If you have sales and marketing managers, you should recruit their help in creating a revenue forecast for the coming period. Forecasting revenue covers last period’s sales, number of units sold, highest earning category, average selling cost, and cost of goods sold.

If nothing has significantly changed, you can base your revenue forecast on sales from the prior period. You can also include customer order contracts and other expected sources of income. Remember, your revenue forecast is a general estimate, but it gives you the foundation for the entire business budget.

Negotiate Prices with Suppliers

As your business grows, the cost of doing business increases, especially raw materials and supplies. Suppose you expect a higher sales volume than last year. In this case, you will likely need to order more supplies to cover the increased demand. Also, fluctuating prices can eat into your profit margin if you decide to order supplies as you go.

Many vendors will charge less per unit for high-volume orders. For this reason, you can ask your vendors whether they have high volume or early payment discounts or are willing to negotiate such a deal. A successful purchase negotiation can significantly improve your small business’s working capital.

Create an Emergency Budget

In business, there is always the possibility of a lawsuit filed by a supplier or buyer. The resulting legal fees and expenses can put a strain on your budget and your brand image. To address this risk and other potentially harmful events, you should compose an emergency budget independent of the other budgets. This step can help you deal with emergencies without taking funds from other budgets or disrupting regular operations.

Focus on Accurate Cash Flow Forecasting

After completing the previous four steps, you can more accurately forecast your cash flow for the new year. The enhanced financial visibility means you can more effectively set monthly payments, sales goals, marketing schedules, and other projects. You can also improve your cash conversion cycle by tweaking payment contracts with buyers by offering early-payment discounts or similar incentives.

How Leveraging Spending Power with an MCA Can Be a Vital Part of Business Budget Planning

Since business budget planning relies on estimates, no budget is perfect or capable of accounting for every possibility. During the coming year, an opportunity to invest in advancing your small business may appear, an emergency expense may exceed your emergency budget, or you may overestimate your earnings for the coming period. These possibilities are why a good relationship with a merchant cash advance provider can help your budget stay on track.

For example, suppose you don’t have the cash available for a large purchase that will save you money in the long run. You can potentially get a lump sum from a Zinch merchant cash advance to cover the cost and pay it back with a percentage of your business’s credit card receipts.

Making Business Budgeting Work for Your Business

The visibility, order, and guidance of business budget planning can help you better align your financial options with your budget, particularly if you partner with an MCA funder like Zinch to handle any cash shortfalls or take advantage of opportunities. Contact us at (714) 500-6622 to explore your options. You may qualify for up to $250,000 in just 24 hours.