Quick Links

ToggleTaking out a loan can be a great way to move your business forward. From funding equipment purchases to giving you some breathing room to get through the slow times, getting your hands on extra cash can open up a wide range of options.

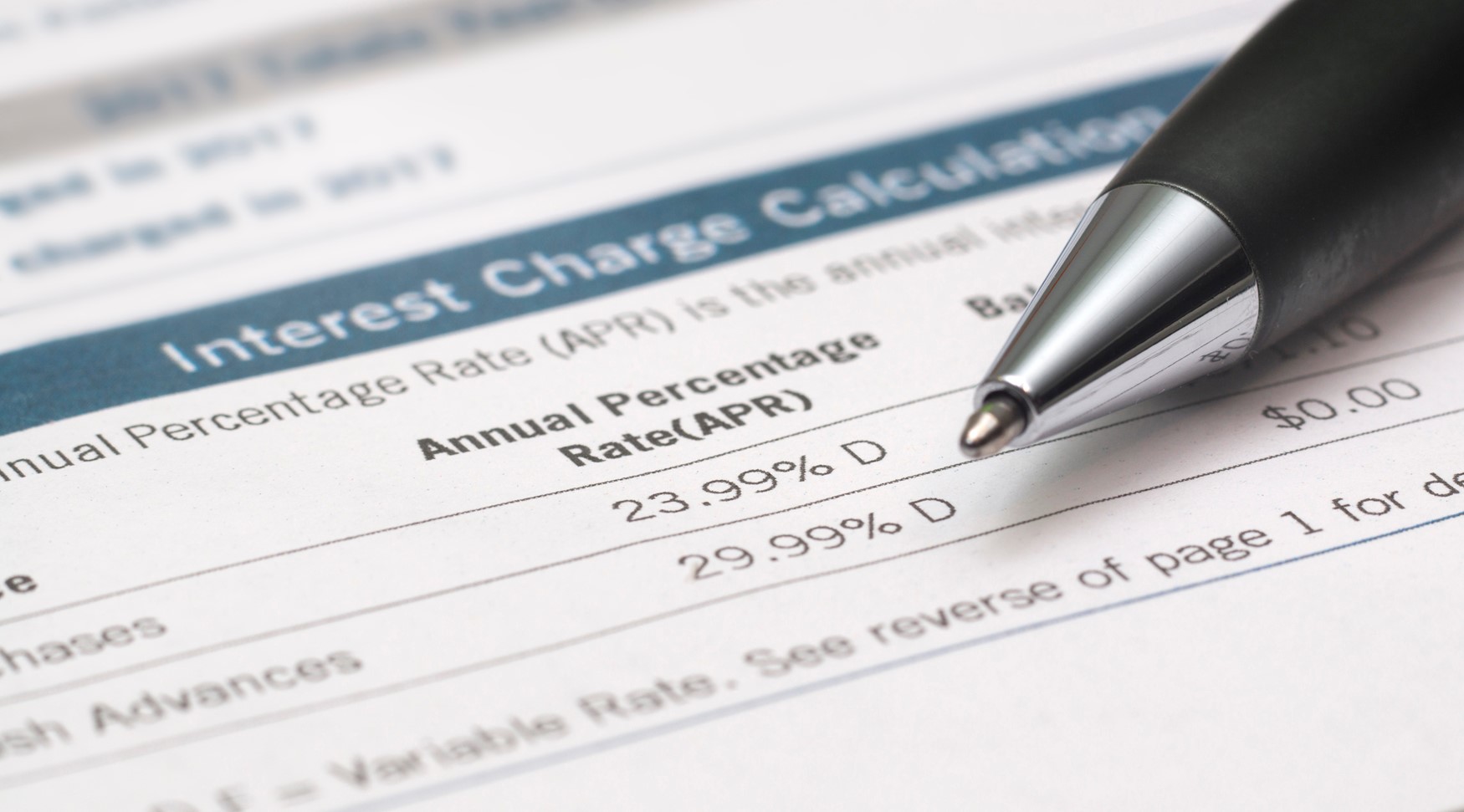

When shopping for a loan, it’s common to look for the option that gives you the smallest monthly payment or the lowest interest rate. However, neither of these numbers tells the whole story. What you really need to look at is the loan’s annual percentage rate, or APR.

What is a small business loan APR and why does it matter? The following guide will tell you everything you need to know so you can compare loan options like a pro.

What Is a Business Loan APR?

An annual percentage rate is the total cost of a loan, stated on an annual basis. This includes the interest rate, origination fees, and any monthly maintenance fees. Comparing the APR, rather than the interest rate or payment amount, will give you a full picture of what the loan truly costs.

When comparing loans, you may find that one lender offers a lower interest rate than another. However, when you add in the other fees, the annual percentage rate is actually higher. This is why it’s so important to know the APR before you commit to a loan.

For example, assume you’re looking at two loans, each for $10,000. If the interest rate on one is 8% and the rate on the other is 10%, you may assume the first option is the best. However, if the first loan has a one-time origination fee and an ongoing monthly maintenance fee, you may find that the APR is actually closer to 12%. Assuming the second loan didn’t have any of these fees, it would be the less expensive option.

Since the formula for calculating APR can be a bit confusing, it’s best to thoroughly read your loan disclosure documents. This will ensure you’re comparing the correct rates.

What Is the Average Business Loan APR?

A loan’s annual percentage rate depends on a variety of factors. This includes (but is not limited to):

- Your personal credit score

- The amount you’re trying to borrow

- Your financial history

- Your history with the lender

- Your business type

- How long your business has been operating

- Your sales volume and cash flow

- The loan type you select

Your APR may be variable or fixed, depending on your loan terms. A variable loan may have a lower APR early on, but this can increase drastically in the future. Make sure to consider this when comparing loans.

Why Is a Small Business Loan APR Higher Than a Personal Loan APR?

If you’re trying to decide between a business loan and a personal loan, you may notice that the APR for the business loan is a bit higher. There are several reasons for this.

No Collateral Requirement

Some loans—like mortgages or auto loans—require you to put the property you’re purchasing up as collateral. If you fail to repay your loan, the bank can take this asset and sell it to make up for the loss. However, since business loans typically do not require collateral, they tend to charge slightly higher interest rates.

Higher Default Risk

Since there are many variables that can impact a business’s success or failure, business loans have a potentially higher default rate. Lenders typically offset this by charging a bit more in interest or fees.

Easier Credit Requirements

Business loans may put less weight on your credit score and evaluate your business finances instead. This means that business owners with less-than-perfect credit can often get approved for a business loan when a personal loan isn’t an option.

What’s the Best Way to Get Funding for My Small Business?

Now that you understand the importance of knowing your loan’s APR, you’re ready to decide whether taking out a small business loan is right for you. Zinch offers a variety of flexible financing solutions for small business owners.

Contact us at (714) 500-6622 to learn more about your options. You could qualify for up to $250,000 in just 24 hours.